Uncover the possibilities

Have You Ever Wondered, What If...?

Navigating the financial landscape can be complex, especially when you're a dental professional with unique financial challenges and opportunities. At WealthFD, we specialize in providing financial services tailored to the needs of dentists. One of the key strategies we use is the 'What-If' analysis - an indispensable tool that can empower you to make informed decisions about your personal financial planning.

Step 1

Define Base Case

We begin by establishing your financial Base Case - a concise overview of your present financial plan and trajectory. This will serve as the 'control' group for evaluating future what-if scenarios, providing a solid basis for informed forecasting and prudent decision-making.

Step 2

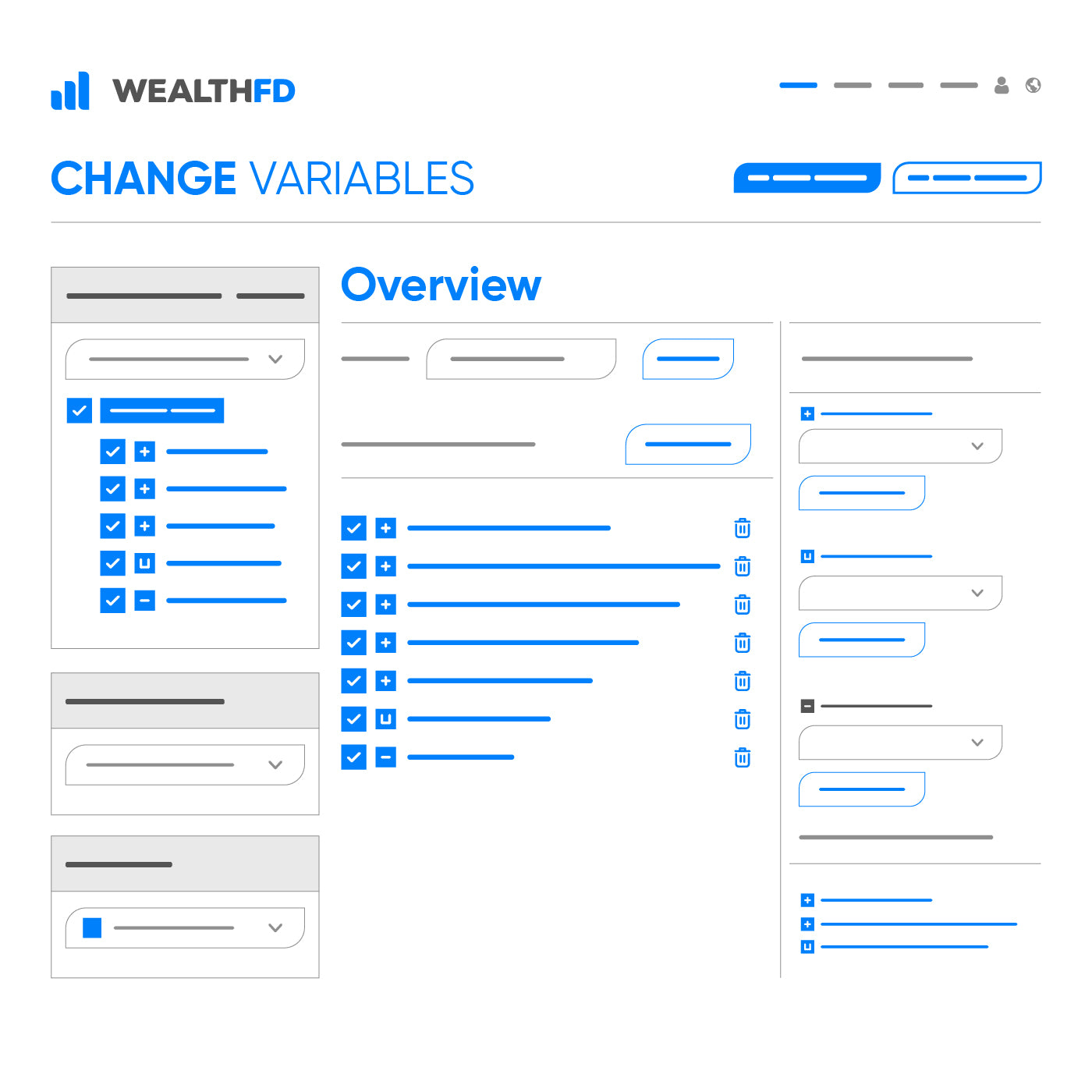

Change Variables

After establishing the base case for your financial plan, we isolate and change variables. Here, we modify factors and assumptions in your financial plan to reflect the financial reality of any life scenarios. This includes increasing, decreasing, adding, removing, delaying, or accelerating income, expenses, liabilities, assets, or strategies.

Step 3

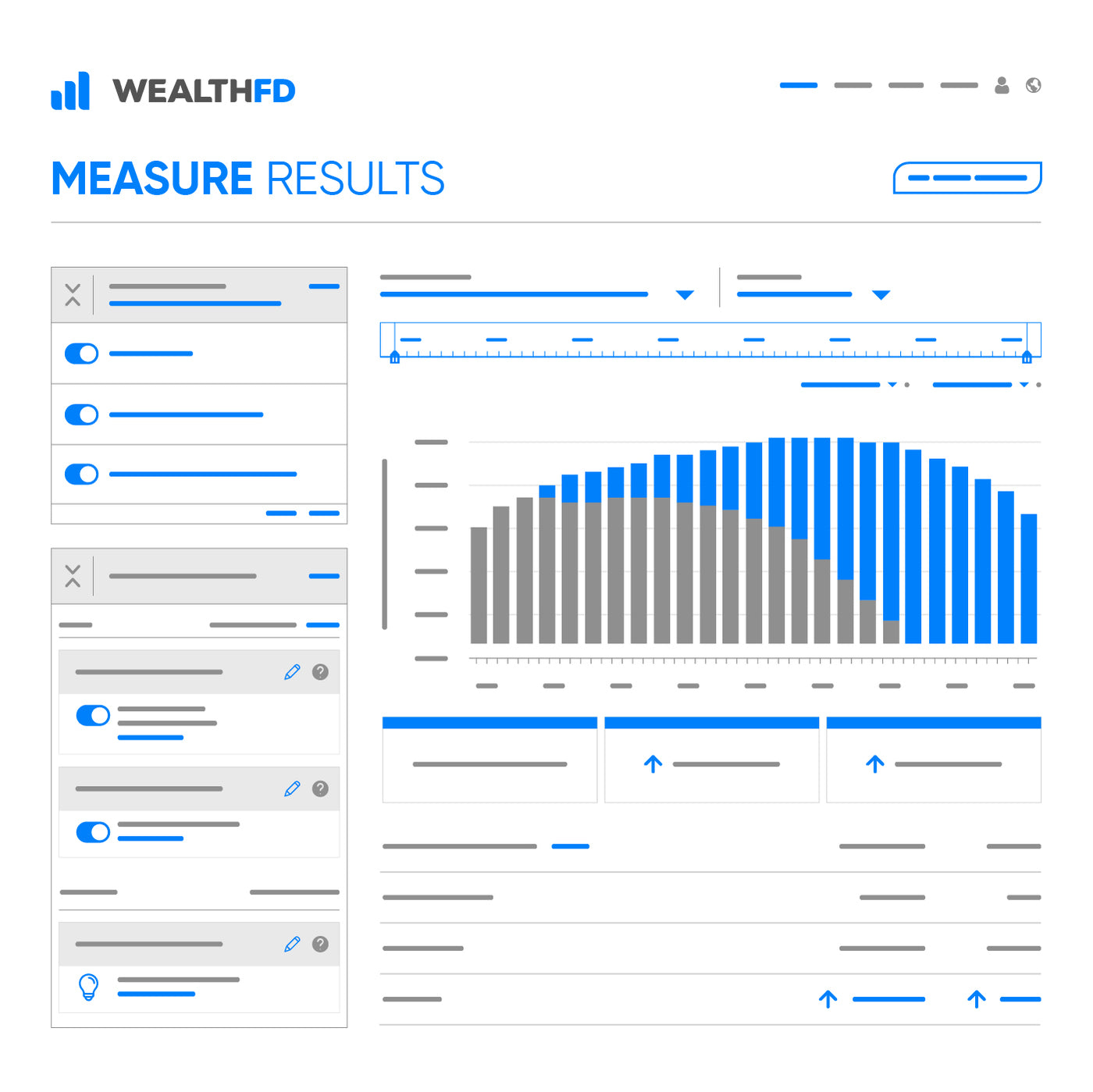

Measure Results

Once we establish the base case and adjust variables to account for various scenarios, our attention turns to assessing the outcomes. We meticulously calculate and analyze the impact of each potential scenario on your financial well-being. Our sophisticated models project the long-term effects of your decisions, examining factors such as cash flow, net worth, tax liability, and investment performance. As your Wealth Manager, we collaborate with you to comprehend and visualize these variances, enabling you to make informed life choices based on sound financial analysis.